Hey investors, Mark Galasiewski here.

Emerging market stocks and interest rates have generally traded inversely to each other over the past few years. We believe that relationship can provide investors important information at present.

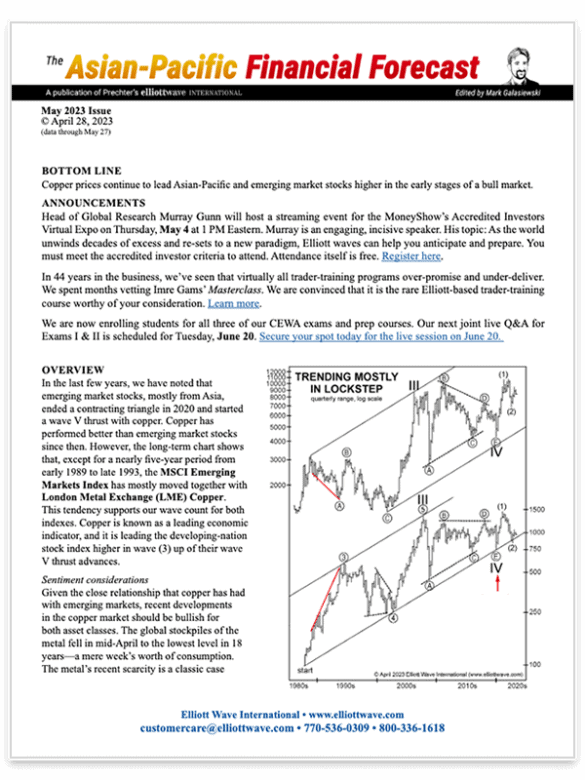

The top graph on this chart is the Bloomberg Emerging Markets Sovereign Yield Index, which is an index of government bond yields in developing nations. The bottom graph is the iShares MSCI Emerging Markets ETF, which is an index of stocks in developing nations.

From 2021 to 2022, the yield index advanced in a smooth impulsive fashion while the stock ETF declined in a choppy corrective fashion. We have to admit that the complexity of the ETF’s decline fooled us more than once, causing us to call the end of the bear market too early.

But by its end, the pattern became clear, especially in the context of the five-wave pattern in the interest rate index. So our November 2022 issue said that “The end of an equity bear market may be coinciding with the end of a bull market in interest rates.”

Because each market ultimately follows its own long-term wave pattern, intermarket relationships like this always break down at some point, and we expect that to be true of emerging market stocks and interest rates in the future.

But for now, they are trending inversely to each other, and our Elliott wave analysis of each market suggests that relationship will continue for a while.

Which way are emerging market stocks and interest rates headed next? To know the answer to that question, check out the January 2024 issue of Asian-Pacific Financial Forecast or Global Market Perspective.

Calling all nail-biters.

Whether you invest in India or China; own tech stocks – or REALLY, REALLY want to own them; trade FX; have given up on cryptos but… “what if?”; wondering if gold is a “buy”; biting your nails about interest rates because you need to borrow or refinance – our Global Market Perspective has got you covered.

See what Elliott waves show for 50+ of the world’s biggest markets in our new Global Market Perspective.

Invest only in Asian-Pacific markets? The Asian-Pacific Financial Forecast is your ticket to get ahead of trends in the region’s top markets.

Asian-Pacific

Financial Forecast

$37

per month

At the beginning of each month, you get a 30-60 day look ahead at the markets. With insightful charts and text, this publication lays out expected trends and turns in this region.

Coverage includes the Nikkei 225, ASX200, Hang Seng, Shanghai Composite, S&P Nifty, SENSEX, Strait Times Index, MSCI Singapore, MSCI Taiwan, TAIEX, KOSPI and more.

Global Market

Perspective

$77

per month

Gives you clear and actionable analysis and forecasts for the world’s major financial markets.

Get insights for the U.S., European and Asian-Pacific main stock indexes, precious metals, forex pairs, cryptos (including Bitcoin), global interest rates, energy markets, cultural trends and more.