GLXY, MARA & COIN’s February surge was in the Elliott wave cards – back in January!

February may have dumped record snowfall across much of the world, but in the universe of cryptocurrencies, the winter month was hot, hot, hot. Down $8000-plus in January with calls for further collapse from notable investors —

Bitcoin pulled a fast one, going from below $40k to almost $70k, a record high, in early March. And right beside it were supportive blockchains Galaxy Digital Holdings (GLXY), Marathon Digital Holdings (MARA), and Coinbase Global Inc. (COIN) soaring in suit.

The bullish performance among the crypto players was classified by the New York Times as a “surge,” by The Guardian as a “revival,” and by Barron’s as a “frenzy.”

From an Elliott wave perspective, however, the sweeping comeback falls under a different classification; namely, an impulsive rally.

The writing for a broadscale bullish set-up first appeared on our wall on January 23. There, in our Trader’s Classroom lesson,senior crypto analyst Jason Soni recorded a special segment on what to expect following impulse waves. The common retracement for a five-wave impulse is the area of the previous fourth wave of one lesser degree. However, when that impulse contains an extended fifth or third wave, the retracement target is different. From Jason:

“Something that people aren’t aware of is…the actual target after the completion of an extended fifth is the second wave of the extended fifth wave.”

The implication being, reversals from extended fifth waves aren’t usually as deep as those of non-extended fifth waves.

In the January 23 Trader’s Classroom, Jason shows this behavior in these crypto leaders:

Galaxy Digital Holdings Ltd (GLXY):

“We need to be wary of being too bearish here. We’ve tested the 50% retracement, so we’ve met the minimum expectations.”

Marathon Digital Holding Inc (MARA):

“You have enough gyrations and you’ve tested targets for what you consider to be an adequate correction, so we have a set-up for a reversal. What I’ll be looking for to argue for a low is a five-wave rally followed by a three-wave pullback.

“We’d like to see Bitcoin rally higher as well to give additional evidence that the crypto markets are set-up to move higher.”

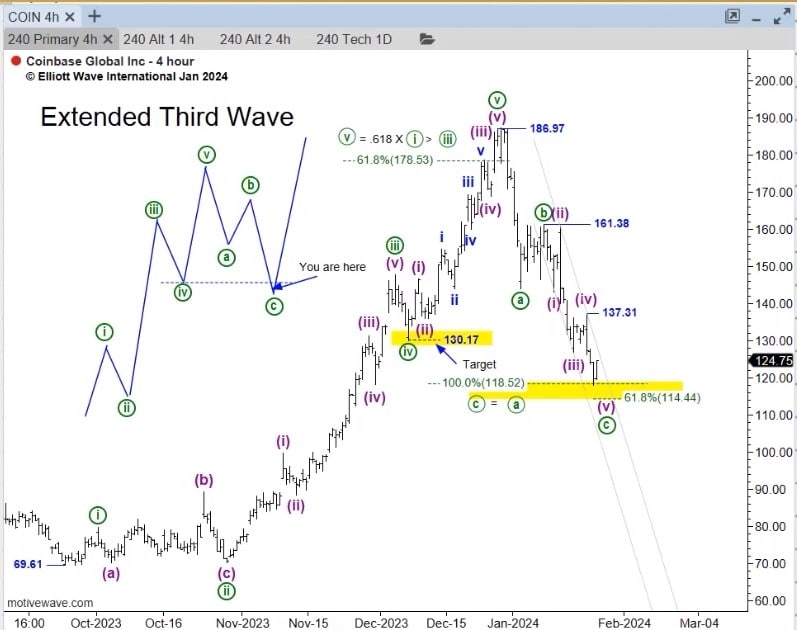

Coinbase Global Inc (COIN):

In this case, the extended impulse wave was in the third-wave position, however, the downside objective in the second wave of the extended sequence still applied:

“We can make a decent case that the correction is close to completion. So a break of the fourth wave extreme at 137.31 ideally with a five-wave rally, followed by a three-wave pullback would offer you a bullish set-up for further rally.”

From there, both GLXY and MARA put in their lows on January 24. Rallies ensued, with GLXY soaring to a 2-year high on February 28 and MARA to multi-month highs on February 28 – right alongside the record-shattering comeback in Bitcoin.

COIN’s trajectory was slower. It continued treading sideways before hitting a low in early February and embarking on a significant rally to the 2-year highs we see today.

Elliott wave analysis is not a crystal ball. It can’t see into a market’s future with total certainty. However, it does provide clear guidelines pertaining to the depth of specific wave structures that fortify one’s ability to identify likely price targets and manage risk. And that’s nothing to sneeze at!

Trading Lessons (Plus, Market Opportunities): 2 for 1

3 times a week, press “Play” and watch one of our 6 experienced analysts explain in comprehensive detail how to recognize the relevant Elliott wave patterns (and supporting technical indicators) underway now and in the future.

This is every Trader’s Classroom video in a nutshell: a lesson, often with a new opportunity in a wide swath of markets from individual stocks, cryptocurrencies, commodities, and more.

Here’s how to watch the latest lessons now.