Here’s a bullish forecast when a “crypto winter” was proclaimed

The price action of bitcoin has been the very epitome of volatility.

The good news for Elliott wave practitioners is that the greater the emotional swings in a financial market, the clearer the Elliott waves – but not at every juncture along a market’s price path.

In other words, Elliott wavers often have to exercise patience as the wave structure resolves itself. At these times, what is called an “alternate” wave count is usually considered. That is – in addition to the preferred wave count, there’s a second-best interpretation.

As Frost & Prechter note in Elliott Wave Principle: Key to Market Behavior:

Because applying the Wave Principle is an exercise in probability, the ongoing maintenance of alternative wave counts is an essential part of using it correctly.

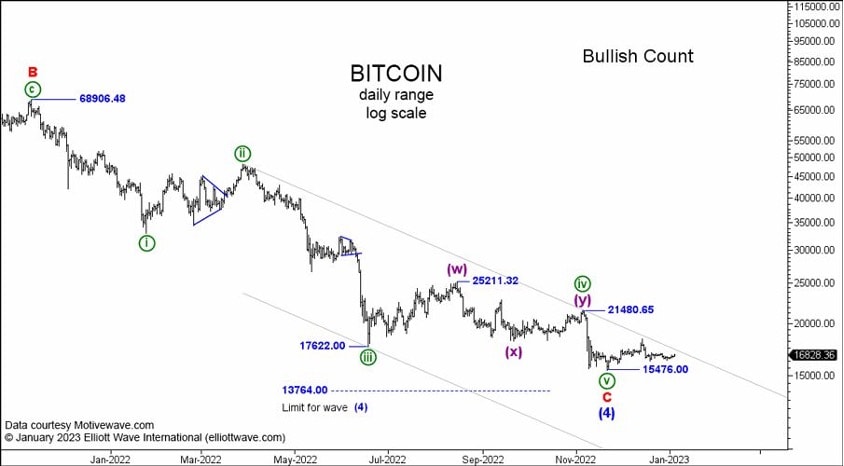

With that in mind, our January 2023 Global Market Perspective was considering both a bearish and bullish scenario for bitcoin – with the bullish scenario being the preferred count. Here’s the chart and brief commentary from that issue:

Under the bullish [scenario for bitcoin,] we’re considering the Intermediate wave (4) correction to have ended at the 15,476 low of November 21.

Mind you, around the time the January 2023 Global Market Perspective published, bearish sentiment toward bitcoin was widespread. Here are some headlines:

- ‘Crypto winter’ has come. Will it become an ice age? (Washington Post, Dec. 18, 2022)

- Bitcoin’s Price Targets for 2023 Are In – and They Are Grim. Brace for a 50% Fall. (Barron’s, Dec. 28, 2022)

However, bitcoin never breached that 15,476 level that was mentioned in our January 2023 Global Market Perspective.

That doesn’t mean that Elliott wave analysis is always perfect, but it does offer context from which to forge a forecast.

Indeed, as of this writing, bitcoin is trading north of 39,000.

Is the rally over – or is there a lot more upside to go?

You may want to check out our Global Market Perspective’s latest analysis and wave count in our “Cryptocurrencies” section.

You can do so by following the link below.

Your Global Investment Opportunity Roadmap for 2024

That “roadmap” is Elliott Wave International’s monthly Global Market Perspective: You can read the January issue online now.

Many of the 50-plus worldwide financial markets it covers are at pivotal junctures – in other words, their chart patterns show price trends that likely stand at the verge of abrupt and dramatic change.

Get ready to avoid risks and embrace opportunities in 2024.

As you look through the Global Market Perspective’s 40-plus pages, you’ll find in-depth coverage of major financial markets in the U.S., Asian-Pacific, Europe and other geographic regions.

You get our forecasts for global stock markets and economies, currencies, cryptocurrencies, bonds, metals, crude oil and more.

Follow the link below to get started now.