Natgas’s multi-month surge was the result of one kind of wave alright – just not a heatwave!

A hotter-than-a-jalapeno-in-Hades-heatwave is set to wreak havoc across the U.S. this week. From the press:

- Millions face record-high temperatures as heat dome intensifies over US — June 17, The Guardian

- A heat wave not seen in decades will send temperatures soaring for more than half the US population — June 17, CNN

- Maps Show “Hot, Hot Heat” Headed to the Northeast U.S. that could Break Dozens of Records, Put Millions at Risk” — June 17, CBS News

The sweltering heat dome could trigger a whole host of troubles from power outages, health-related issues for the young and elderly, water shortages, wildfires, and more.

But (you knew it was coming) – when the mainstream financial experts cite the same heat dome for directly causing natural gas prices’ surge to five-month highs on June 11, I’ve got to object. From MarketWatch on June 11:

“Natural gas surges over 7% to end at 5-month high on forecasts for extreme heat.”

The reason for my objection, you may ask?

Well, first of all, natural gas is used for heating, not cooling. So, what does a heatwave have to do with natural gas?

And secondly – and this is a more important objection even if I am somehow overlooking the heatwave/demand for natural gas connection — natural gas prices started rising weeks before the heat dome was a blip on the national Doppler radar.

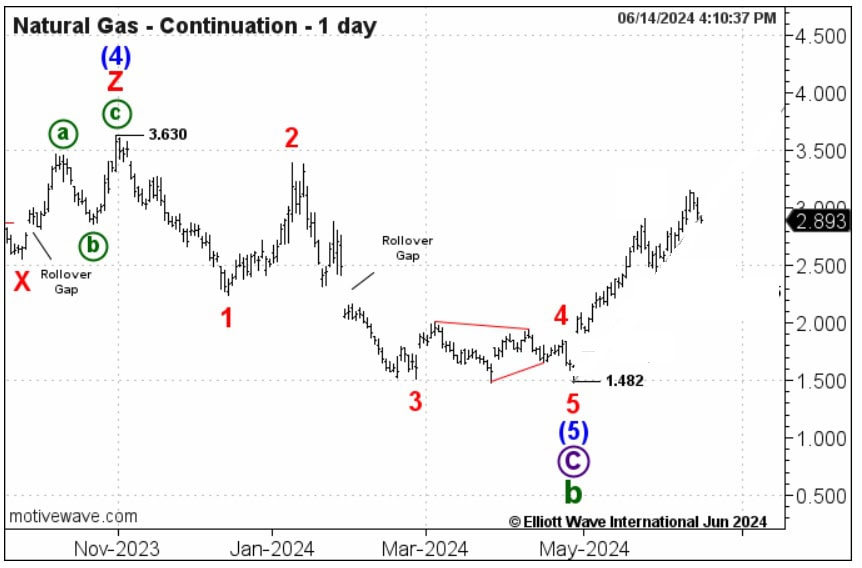

In fact, as early as April 26, when the weather was cool and pleasant, our Energy Pro Service identified an alternate bullish set-up on the Elliott wave radar in natural gas.

Namely, in the April 26 Energy Pro Service, we labeled a potential fifth wave bottom in place at the current low and said:

“We’re at a crossroads. We can easily make the case for the possibility that the alternate count is in force.. The minimum structural and price requirements for wave 5 are in place. A move above 1.848 would leave the structure with a completed look.”

Then on May 1, after natural gas prices showed their strength, Energy Pro Service confirmed the bottom:

The continuation chart can be counted as complete. Ideally June’s 1.909 selloff low that we hit last Friday will stay intact. Ideally, this thing will catch some life and move on up.

And from there, natural gas prices embarked on a blistering rally to 5-month highs on June 11 before cooling down.

Now, our latest Energy Pro Service analysis of natural gas reveals critical price levels that would support a return to (and possibly well above) the $3 area.

Things are only heating up outside. And while we wish that every single forecast we make turned out like this one – and they don’t! — for traders who want to stay cool in one of the most volatile commodity markets on the planet, our Energy Pro Service might just offer a breath of fresh air.

Oil, NatGas & More: Energy Opportunities on Every Time Frame

For active traders watching the intraday, daily and weekly price movements in the energy markets, our Energy Pro Service presents detailed Elliott wave analyses that focus on meaningful developments underway in crude oil, natural gas, heating oil, unleaded and more.

Energy Pro Service helps you to shift from simply following market trends to predicting their objective paths of least resistance.