On June 2, OPEC reached a decision to extend oil production cuts into the next year.

The mainstream logic that follows is this:

Oil supply down; oil prices up.

Yet hours after the announcement, crude prices tanked. What happened?

Robert Prechter’s Socionomic Theory of Finance explains that oil prices are driven not by the governments or oil producers but by the collective mood of the energy market participants.

In fact, Prechter dedicated an entire chapter to explain why headline-worthy market fundamentals failed to produce the result expected by the mainstream.

Here’s the real-time explanation behind crude’s “unexpected” drop on June 3:

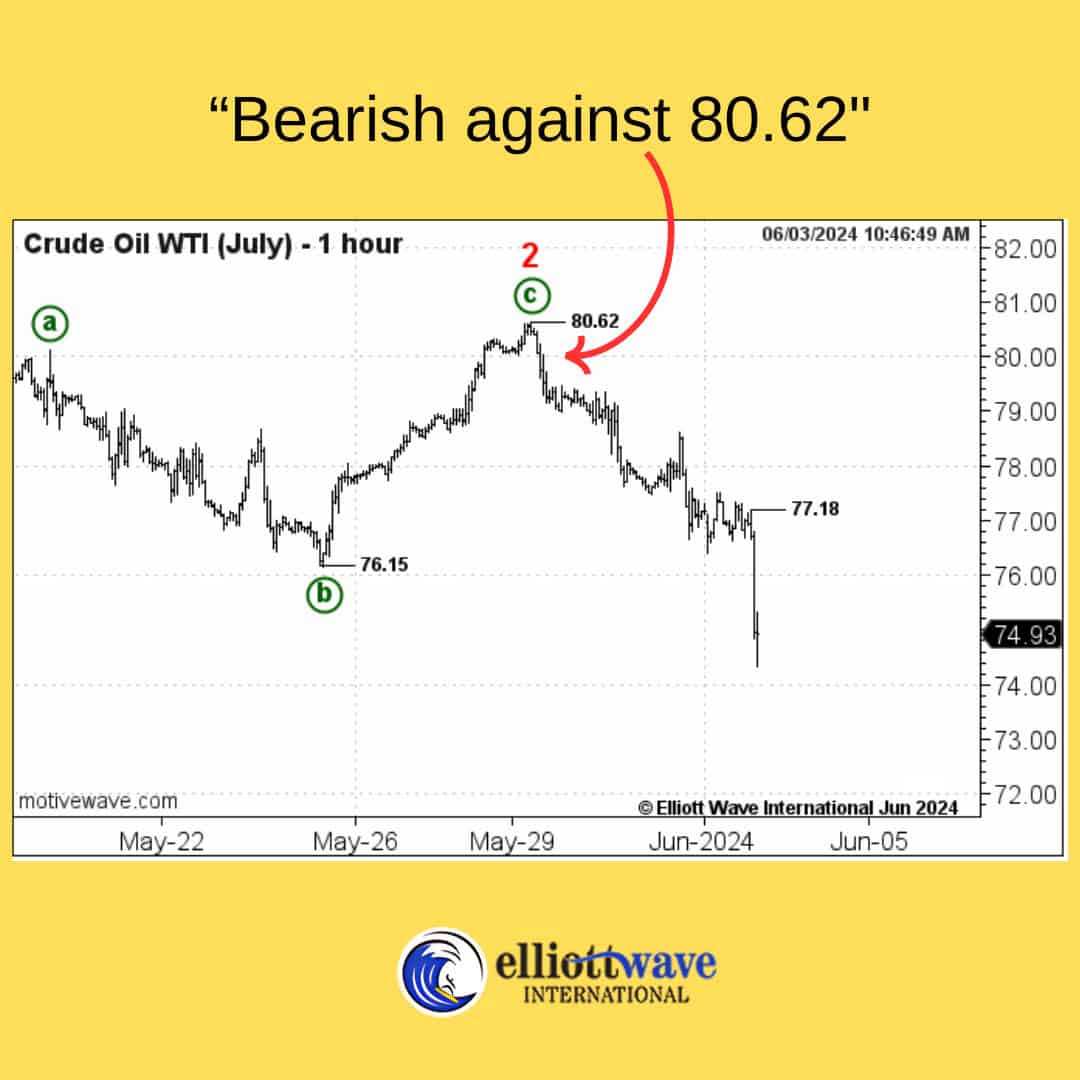

A few days earlier, on May 29, EWI’s Energy Pro Service editor Steven Craig told subscribers:

“Bottom Line: It’s aggressive, but a bearish stance against 80.62 seems warranted. Crude needs to extend the decline from the 80.62 overnight high in an impulsive manner to advance the notion that wave 2 has ended.”

And here’s what happened:

Want More Market Insights, Free Reports & Special Events?

Join Club EWI –Today.

Club EWI is the launchpad for your Elliott wave journey. With over half a million traders and investors beginning their journey here, Club EWI is by far the world’s most popular starting point for people who want to use Elliott. Here, you learn to spot high-confidence opportunities, set targets and objectively time your market and money decisions.

Club EWI members pay a nominal fee ($2/month). In return, you get complimentary access to resources including articles, reports, videos, and special events — all from the best educators and analysts in the business.