Many got blinded by Tesla’s bearish trend since late 2021 – but for some it was “blindingly obvious” – here’s why.

On April 16, Tesla CEO and Mr. Tweet himself Elon Musk took to X to express his confidence in the future of FSD (full, self-driving) robotaxis amidst a slowdown in electric models. “It’s a blindingly obvious” move to focus on autonomy, wrote Musk. (Investor’s Business Daily, April 17)

You know what isn’t blindingly obvious to Tesla investors, however, is why share prices of the world’s richest man’s company have been in free fall since 2021?

Let’s self-drive it back to late 2021. In November 2021, Tesla stock (TSLA) rocketed to all-time highs and hit the $1 T-T-Trillion valuation mark. And on Dec. 13, Time Magazine featured Elon Musk as its 2021 Person of the Year.

The profile went in depth, illuminating the paradoxes of a man who, one minute, launches rockets into outer space and plans to colonize Mars, and the next live Tweets “his poops from his Porcelain Throne.”

Suffice to say, according to the mainstream experts, Tesla’s stock was NOT expected to suffer a similar, “splish splash” (Musk’s words) down the toilet fate. Here, these news items from late 2021 capture the bullish enthusiasm for TSLA’s future:

- “To the Moon: Tesla Stock is Trading Like a Meme” – The Street, Nov. 3

- “Tesla Stock Target Boosted to $1400 As EV Maker Seen Owning Big Chunk of EV Revolution. Analysts are saying that the electric vehicle ‘revolution’ presents a $5 trillion market opportunity ‘over the next decade with Tesla leading the way.’” – Barron’s Nov. 19

- “It’s a Twilight Zone world that Tesla is actually viewed as a safety blanket stock in rocky times… He rates Tesla stock at Buy and has a target of $1,400 for the price.” – Barron’s, Dec. 1

But while Tesla’s bull run seemed unstoppable from a “fundamental” perspective, a stop – or TOP – for that matter seemed very much within reach from our point of view.

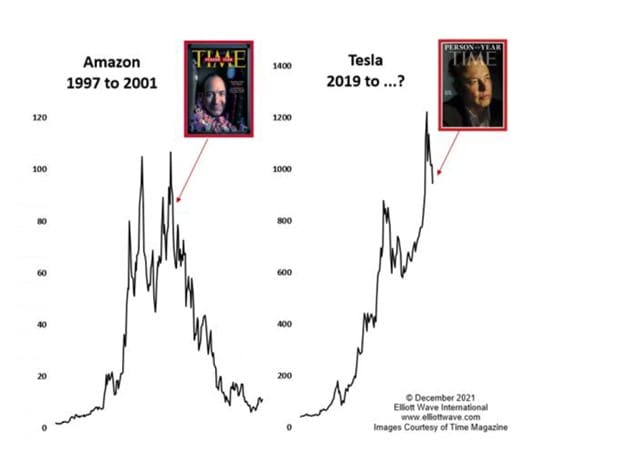

Here, in the December 15, 2021 European Short-Term Update we featured Tesla in a special segment titled “This could be the cherry on top of the icing on the cake.” There, we referenced the Paul Macrae Montgomery “magazine-cover indicator,” for which TIME magazine was used as a proxy for his initial studies. The Dec. 15 European Short-Term Update takes it from here:

The thesis is that whenever a theme or fad reaches the cover of Time, it usually marks an end (or a significant pause) in the mania.

One of the most famous occurrences of the indicator proving correct came at the end of 1999 when Time magazine featured a picture of Jeff Bezos on its front cover as its “Person of the Year.” In the two years prior, the share price of Bezos’s Amazon had advanced by 8,500% as the mania over the internet reached a crescendo. The Time cover appeared as Amazon’s share price was just starting a crash that would see 95% wiped off its value in the next two years amidst a general bear market.

Fast forward to 2021, and Time magazine has just released its Person of the Year with Elon Musk adorning the front cover. The share price of Musk’s electric vehicle company, Tesla, has advanced by 41,333% from 2011 until its high last month, with the advance since 2019 alone being a stunning 3,411%.

It would appear that there is a very similar set up between 2021 and 1999. Both occurrences fulfill Montgomery’s criteria. Note also, that the share prices of Amazon and Tesla are both slightly below their highs when the Time magazine cover appeared… It could be that Time magazine has, once again, lived up to its name.

From its November 4, 2021, all-time high, TSLA stock plunged 70% to 2-year lows in January 2023 before rallying, then falling once again to the 12-month low we see today.

On April 16, Yahoo Finance called Tesla shares “street low.” As for how long they’ll stay low, our sister service Trader’s Classroom is on the case. On April 17, Trader’s Classroom editor Robert Kelley, who specializes in individual stocks, presented an updated wave count for TSLA. Robert identifies a clear resistance level that must stay intact for the risk to remain to the downside.

Also presents high-potential wave counts for Apple, Amazon, Microsoft, Caterpillar, and more!

Who Will Kiss Historic Highs Goodbye Next?

Before the toilet-flushing reversal in Tesla shares unfolded in 2021, it was “blindingly obvious” to subscribers of our European Short-Term Update. If your focus is exclusively on near-term changes unfolding in European markets alone, European Short-Term Update may be the ideal fit.

But for active traders, our sister Traders Classroom presents real-time, video coverage of the world’s leading stocks, bonds, cryptocurrencies, commodities, and more! In the April 17 Trader’s Classroom, TSLA is in the company of Apple, Amazon, Microsoft, Caterpillar, and more! Choose the service that’s the best fit for you!

I want to learn to trade

using Elliott Waves

3 times a week, Trader’s Classroom brings you a short video lesson. You’ll see real markets and practical trading tips to help you spot high-confidence trading opportunities.

$97

I need short term coverage

of European markets

3 times a week, the European Short-Term Update alerts you to what’s changed and what’s upcoming in the next several days for Europe’s major stock indexes, bonds and the euro.